Direct and Indirect Expenses:

Learning Objectives:

-

Define and explain

direct and indirect expenses.

-

What is the difference between direct and indirect

expenses?

Expenses means the expired costs incurred for

earning revenue of a certain accounting period. They

are the cost of the goods and services used up in

the process of obtaining revenue. In other words, it

becomes possible to earn revenue with the help of

expenses. For example, purchase of goods, wages,

salaries, rent, carriage, customs duty etc. We have

to incur all these expenses in order to earn

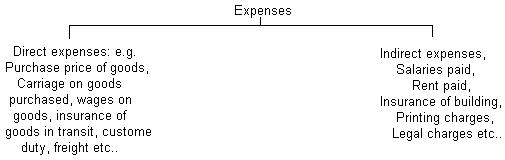

revenue. Expenses are mainly divided into two

categories:

-

Direct

expenses

-

Indirect expenses

These two

types of expenses are briefly discussed below:

Direct Expenses:

Expenses

connected with purchases of goods are known as direct

expenses. For example, freight, insurance, of goods

in transit, carriage, wages, custom duty, import duty,

octroi duty etc. Without incurring these expenses, it is

not possible to bring the goods from the purchase point

to the godown of the business. such expenses are

collectively known as direct expenses.

Indirect Expenses:

All expenses other

than direct expenses are assumed as indirect

expenses. Such expenses have no relationship

with purchase of goods. Examples of indirect expenses

include rent of building, salaries to employees,

legal charges, insurance of building, depreciation,

printing charges etc. So

|