|

Learning objectives of this

article:

-

What is difference between nominal and effective

interest rate.

-

How effective interest rate is determined?

Contents:

Interest rates are typically stated as annual

percentages. The stated annual rate is usually

referred to as the nominal rate.

Interest may be compounded semiannually, quarterly,

and monthly, the interest earned during a year is

greater than if compounded annually. When

compounding is done more frequently than annually,

an effective annual interest rate can

be determined. This is the interest rate compounded

annually which is equivalent to a nominal rate

compounded more frequently than annually. The two

rates would be considered equivalent if both result

in the same compound amount.

Let r equal the effective annual interest rate, i

the nominal annual interest rate, and m the number

of compounding periods per year. The equivalence

between the two rates suggests that if a principle P

is invested for n years, the two compound amounts

would be the same, or

A small company has made a log-term investment of

$250,000. The interest rate is 12%, and interest is

compounded quarterly. Calculate annual

effective interest rate.

Solution:

|

In this example the investment is made

with a nominal interest rate of 12

percent per year compounded quarterly.

For this investment:

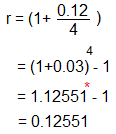

The effective annual interest rate is

calculated as follows:

The effective annual

rate is 12.551 percent

*Future

value of $1 table - (1 + i)n

table, we can determine that (1+0.03)4

= 0.12551

|

|

|

|

Practice

Exercise: The nominal

interest rate on an investment is 7

percent per year. What is the effective

annual interest rate if interest is

compounded semiannually?

Answer: 7.122 percent |

|