|

Learning Objectives:

-

What is the difference between direct and

indirect method of cash flow statement?

-

Calculate net cash provided or used by operating

activities using direct and indirect method.

|

If

you are really serious about learning cash flows

from operating activities then read this page

very carefully. You will find significant

improvement in your understandings. |

Two

different methods available to adjust income from

operations on an accrual basis to net cash flow from

operating activities are the

indirect

(reconciliation) method and the

direct (income

statement) method.

Indirect Method or Reconciliation

Method:

Indirect method is the most widely used method for

the calculation of net cash flow from operating

activities. Under this method, net cash provided or

used by operating activities is determined by adding

back or deducting from net income those items that

do not effect on cash. The following are the common

types of adjustments that are made to net income to

arrive at net cash flow from operating activities.

Adjustments Needed to Determine Net Cash Flow from

Operating Activities Using Indirect Method

|

Net

Income |

|

Additions |

Deductions |

|

Depreciation expense |

Amortization of bond premium |

|

Importance of intangibles and

deferred charges |

Decrease in deferred income tax

liabilities |

|

Amortization of bond discount |

Income

on investment in common stock using

equity method |

|

Increase in deferred income tax

liability |

Gain

on sale of plant assets |

|

Loss

on investment in common stock using

equity method |

Increase in receivables |

|

Loss

on sale of plant assets |

Increase in inventories |

|

Loss

on written down of assets |

Increase in prepaid expenses |

|

Decrease in receivables |

Decrease in accounts payable |

|

Decrease in inventories |

Decrease in accrued liabilities |

|

Decrease in prepaid expenses |

|

|

Increase in accounts payable |

|

|

Increase in accrued liabilities |

|

|

The

additions and deductions listed above reconcile net

income to net cash flow from operating activities,

illustrating the reason for referring to the

indirect method as reconciliation method.

|

Note:

Direct and indirect methods are different

only to the extent of the calculation of

cash flows from operating activities, cash

flows from investing and financing

activities are calculated in the same

manner. |

Example:

|

Cash

flow from operating activities: |

|

|

|

Net

income |

|

117000 |

|

Adjustments to reconcile net income

to net cash used/provided by

operating by activities: |

|

|

|

Depreciation expenses |

14,800 |

|

|

Amortization of trade mark |

2,400 |

|

|

Amortization of bond premium |

(1,000) |

|

|

Equity in earnings of Porter Co. |

(3,500) |

|

|

Gain on condemnation of land |

(8,000) |

|

|

Loss on sale of equipment |

1,500 |

|

|

Increase in deferred tax liabilities |

3,000 |

|

|

Increase in accounts receivable

(net) |

(53,000) |

|

|

Increase in inventories |

(152,000) |

|

|

Decrease in prepaid expenses |

500 |

|

|

Increase in accounts payable |

1,000 |

|

|

Increase in accrued liabilities |

4,000 |

|

|

Decrease in income tax payable |

(13,000) |

203,500 |

| |

|

|

|

Net cash

used by operating activities |

|

(86,500) |

|

|

|

|

|

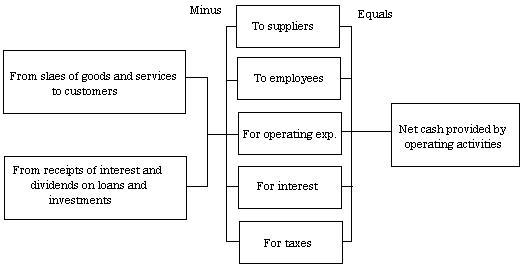

Direct Method or Income Statement

Method:

Under

the direct method the statement of cash flows

reports net cash flow from operating activities as

major classes of operating cash receipts (e.g., cash

collected from customers and cash received from

interest and dividends) and cash disbursements

(e.g., cash paid to suppliers for goods, to

employees for services, to creditors for interest,

and to government authorities for taxes).

The

direct method is explained on

cash

flow statement direct method page. This method

is illustrated here in more detail to help you

understand the difference between accrual based

income and net cash flow from operating activities

and to illustrate the data needed to apply the

direct method.

Suppose a company which began business on January 1,

2005, has the following balance sheet information:

| |

December 31 |

|

|

2005 |

2004 |

|

Cash |

$159,000 |

0 |

|

Accounts receivable |

15,000 |

0 |

|

Inventory |

160,000 |

0 |

|

Prepaid expenses |

8,000 |

0 |

|

Property, plant, and equipment (net) |

90,000 |

0 |

|

Accounts payable |

60,000 |

0 |

|

Accrued expenses payable |

20,000 |

0 |

|

Company's December 31, 2005, income statement and

additional information are:

|

Revenues from sales |

|

$780,000 |

|

Cost

of goods sold |

|

450,000 |

|

|

|

|

|

Gross

profit |

|

330,000 |

|

Operating expenses |

$160,000 |

|

|

Depreciation |

10,000 |

170,000 |

|

|

|

|

|

Income

before income taxes |

|

160,000 |

|

Income

tax expenses |

|

48,000 |

|

|

|

|

|

Net

income |

|

$112,000 |

|

|

|

|

Additional Information:

(a). Dividends of $70,000 were declared

and paid in cash.

(b). The accounts payable increase resulted

from the purchases of merchandise.

(c). Prepaid expenses and accrued expenses

payable relate to operating

expenses. |

Under

the direct method, net cash provided by operating

activities is computed by adjusting each in the

income statement from the accrual basis to the cash

basis. To simplify and condense the operating

activities section, only major classes of operating

cash receipts and cash payments are reported. The

difference between these major classes of cash

receipts and cash payments is the net cash provided

by operating activities as show below:

Net

Cash Provided by Operating Activities

An

efficient way to apply the direct method is to

analyze the revenues and expenses reported in the

income statement in the order in which they are

listed. Cash receipts and cash payments related to

these revenues and expenses should then be

determined. The direct method adjustments for the

company in 2005 to determine net cash provided by

operating activities are presented in the following

sections.

Cash

Receipts from Customers:

The

income statement of the company reported revenues

from customers of $780,000. To determine cash

receipts from customers, it is necessary to consider

the change in accounts receivables during the year.

When accounts receivable increase during the year,

revenues on an accrual basis are higher than cash

receipts from customers. In other words, operations

led to increased revenues but not all of these

revenues resulted in cash receipts. To determine the

amount of increase in cash receipts, deduct the

amount of the increase in accounts receivable from

the total sales revenue. Conversely, a decrease in

accounts receivable is added to sales revenues,

because cash receipts from customers then exceed

sales revenue. In our example, accounts receivable

increased by $15,000. Thus, cash receipts from

customers were $765,000, computed as follows:

|

Revenues from sales |

$780,000 |

|

Deduct: Increase in accounts

receivable |

15,000 |

|

|

|

|

Cash

receipts from customers |

$765,000 |

|

|

|

|

Cash

receipts from customers may also be determined from

an analysis of the accounts receivable account as

shown below:

Accounts Receivable

1/1/05

Balance

-0-

Revenue from sales

780,000 |

Receipts from customers

765,000 |

|

12/31/05

Balance

15,000 |

|

The

relationship between cash receipts from customers,

revenues from sales, and changes in accounts

receivable are shown below:

Formula to

compute cash receipt from customers

|

Cash

receipts from customers |

= |

Revenues from sales |

{ |

+

Decrease in accounts receivable

or

- Increase in accounts receivable |

|

Cash Payments to Suppliers:

In our

example, company reported

cost of

goods sold on its

income

statement of $450,000. To determine cash payment to

suppliers, it is first necessary to fine for the year.

To find purchases, cost of goods sold is adjusted for

the change in inventory. When inventory increases during

the year, it means that purchases this year exceed cost

of goods sold. As a result, the increase in inventory is

added to cost of goods sold to arrive at purchases.

In 2005

the company's inventory increased $160,000. Purchases,

therefore, are computed as follows:

|

Cost

of goods sold |

$450,000 |

|

Add:

Increase in inventory |

160,000 |

|

|

|

|

Purchases |

$610,000 |

|

|

|

|

After

purchases are computed, cash payments to suppliers

are determined by adjusting purchases for the change

in accounts payable. When accounts payable increase

during the year, purchases on an accrual basis are

higher than they are on a cash basis. As a result,

an increase in accounts payable is deducted from

purchases to arrive at cash payments to suppliers.

Conversely, a decrease in accounts payable is added

to purchases because cash payments o suppliers

exceed purchases. Cash payment to suppliers are

$550,000 computed as follows:

|

Purchases |

$610,000 |

|

Deduct: Increase in accounts payable |

60,000 |

|

|

|

|

Cash

payments to suppliers |

$550,000 |

|

|

|

|

Cash

payments to suppliers may also be determined from an

analysis of the accounts payable account as shown

below:

Accounts Payable

|

Revenue from sales

550,000 |

1/1/05

Balance

-0-

Revenue from sales

610,000 |

| |

12/31/05

Balance

60,000 |

The

relationships between cash payments to customers, cost

of goods sold, changes in inventory, and changes in

accounts payable are shown below:

Formula to

compute cash payments to suppliers

|

Cash

payments to suppliers |

= |

Cost

of goods sold |

{ |

+

Increase in inventory

or

- Decrease in inventory |

{ |

+

Decrease in accounts payable

or

- Increase in accounts payable |

|

Cash

Payments for Operating Expenses:

In our

example, the operating expenses of $160,000 are reported

on the income statement of the company. To determine the

cash paid for operating expenses, this amount must be

adjusted for any changes in prepaid expenses and accrued

expenses payable. For example, when prepaid expenses

increased $8,000 during the year, cash paid for

operating expenses was $8,000 higher than operating

expenses reported on the income statement. To convert

operating expenses to cash payments for operating

expenses, the increase of $8,000 must be added to

operating expenses. Conversely if prepaid expenses

decrease during the year, the decrease must be deducted

from operating expenses

Operating

expenses must also be adjusted for changes in accrued

expenses payable. When accrued expenses payable increase

during the year, operating expenses on an accrual basis

are higher than they are on a cash basis. As a result,

an increase in accrued expenses payable is deducted from

operating expenses to arrive at cash payments for

operating expenses. Conversely, a decrease in accrued

expenses payable is added to operating expenses because

cash payments exceed operating expenses. The cash

payments for operating expense of the company in our

example is $148,000 computed as below:

|

Operating expenses |

$160,000 |

|

Add:

Increase in prepaid expenses |

8,000 |

|

Deduct: Increase in accrued expenses

payable |

(20,000) |

|

|

|

|

Cash

payments to suppliers |

$148,000 |

|

|

|

|

The

relationships among cash payments for operating

expenses, changes in prepaid expenses, and changes

in accrued expenses payable are shown below:

Formula to

compute cash payments for operating expenses

|

Cash

payments for operating expenses |

= |

Operating expenses |

{ |

+

Increase in prepaid exp.

or

- Decrease in prepaid exp. |

{ |

+

Decrease in accrued exp. payable

or

- Increase in accrued exp. payable |

|

Depreciation expense has not been considered,

because depreciation is a non-cash expense.

Cash

Payments for Income Taxes:

The income

statement of the company in our example shows income tax

expenses $48,000. This amount equals the cash paid

because the comparative balance sheet indicates no

income tax payable at either the beginning or end of the

year.

Summary of Net Cash Flows from

Operating Activities - Direct method:

The

computations illustrated above are summarized in the

following schedule:

Accrual

Basis to Cash Basis

|

Accrual Basis |

|

Adjustments |

Add

(Subtract) |

Cash

Basis |

|

Revenue from sales |

$780,000 |

- |

Increase in accounts receivable |

$(15,000) |

$765,000 |

|

Cost

of goods sold |

450,000 |

+ |

Increase in inventory |

160,000 |

|

| |

|

- |

Increase in accounts payable |

(60,000) |

550,000 |

|

Operating expenses |

160,000 |

+ |

Increase in prepaid expenses |

8,000 |

|

| |

|

- |

Increase in accrued expenses |

(20,000) |

148,000 |

|

Depreciation expenses |

10,000 |

- |

Depreciation expenses |

(10,000) |

-0- |

|

Income

tax expenses |

48,000 |

|

|

|

48,000 |

| |

|

|

|

|

|

|

Total

expenses |

668,000 |

|

|

|

746,000 |

| |

|

|

|

|

|

|

Net

income |

$112,000 |

|

Net

cash provided by operating

activities |

$19,000 |

| |

|

|

|

|

|

|

Presentation of the direct method for reporting net

cash flow from operating activities takes the

following form:

|

Cash

received from operating activities: |

|

|

|

Cash

received from customers |

|

$765,000 |

|

Cash

payments: |

|

|

|

To

suppliers |

$

550,000 |

|

|

For

operating expenses |

148,000 |

|

|

For

income taxes |

48,000 |

746,000 |

|

|

|

|

|

Net

cash provided by operating

activities |

|

$19,000 |

|

|

|

|

|

If the

company uses the direct method to present the net

cash flows from operating activities, it will

provide a separate schedule of the reconciliation of

net income to net cash provided by operating

activities. The reconciliation assumes the identical

form and content of the indirect method of

presentation as shown below:

|

Cash

flow from operating activities: |

|

|

|

Net

income |

|

$112,000 |

|

Adjustments to reconcile net income

to net cash used by

operating by activities: |

|

|

|

Depreciation expenses |

10,000 |

|

|

Increase in accounts receivable

|

(15,000) |

|

|

Increase in inventories |

(160,000) |

|

|

Increase in prepaid expenses |

(8,000) |

|

|

Increase in accounts payable |

60,000 |

|

|

Increase in accrued expenses payable |

20,000 |

$(93,000) |

| |

|

|

|

Net cash

provided by operating activities |

|

$19,000 |

|

|

|

|

|

The reconciliation

may be presented at the bottom of the statement of

cash flows when the direct method is used or in a

separate schedule.

|