|

In

business concerns, numerous bills of exchange are

drawn and accepted. Special journals are used to

record bills of exchange, called bill receivable

journal and bill payable journal. From these two

journals the totals are posted to bills receivable

account and bills payable account respectively.

Every

bill has two different aspects. To the drawer who

has sold goods and wants to be paid for them, it is

a bill receivable, he hopes to receive money on the

due date. Such bills are recorded in the bills

receivable journal. It is a sort of asset for the

drawer and as good as money. To the acceptor of the

bill, who has bought goods on credit and has agreed

to honor the bill on the due date, it is a bill

payable. The acceptor must arrange in due course the

funds available to honor the bill when it falls due.

Such bills are recorded in the bills payable

journal.

Explanation with an Example:

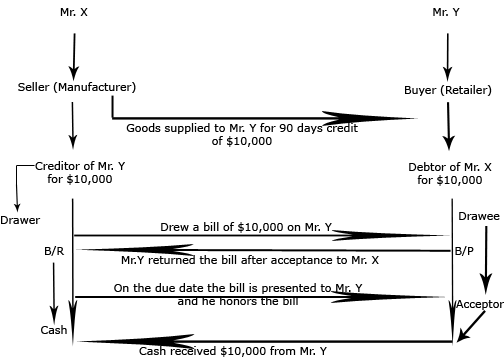

We can

understand the accounting of bills of exchange with

the help of an example. Let us suppose, Mr X is a

manufacturer of shoes and Mr. Y is a retail trader

of shoes. Mr. Y (the buyer) wishes to buy shoes from

the manufacturer but has no money. He is agreed to

accept a bill of exchange for 90 days, if goods are

sold to him on credit basis. So both the parties

agreed. Mr. X supplies goods to Mr. Y worth $10,000

for a 90 days credit and draws upon him a bill for

the full value of goods for 90 days on 1st Jan.

2005.

The

illustration given above can be summarized below:

|

Mr. X becomes

creditor and Mr. Y becomes debtor. |

|

|

Acceptance

received from Mr. Y. |

There are three

transactions which have taken place:

- Mr. X sold

goods to Mr. Y worth $10,000 on credit basis.

- Mr. X drew a

bill of exchange on Mr. Y for 90 days for

$10,000.

- On the due

date the bill was presented to Mr. Y and he

honored the bill (met his obligation on the due

date)

Journal Entries:

Now we shall see

how these transactions are recorded in journal of

Mr. X and Mr. Y.

Mr. X's Journal

Transaction

No.1

Mr. X sold goods to

Mr. Y for $10,000 on credit. The journal entry is:

1st Jan.

2005 |

Y A/c

Dr.

Sales A/c

(Goods sold on credit) |

|

10,000 |

10,000 |

Transaction

No. 2

Mr. Y drew a bill

on Mr. X for 90 days. The journal entry is:

1st Jan.

2005 |

Bill

receivable A/c

Dr.

Y A/c

(Acceptance received from Mr. Y) |

|

10,000 |

10,000 |

Transaction

No. 3

On the due date

acceptor honors the bill. The journal entry is:

4 April.

2005 |

Cash/Bank A/c

Dr.

Bill receivable A/c

(Received cash on presentation of bill) |

|

10,000 |

10,000 |

Mr. Y's Journal

Transaction

No.1

Bought goods from

Mr. X for $ 10,000. The journal entry is:

1st Jan.

2005 |

Purchases A/c

Dr.

X A/c

(Goods purchased on credit) |

|

10,000 |

10,000 |

Transaction

No. 2

Acceptance given to

Mr. X instead of paying him cash. The journal entry

is:

1st Jan.

2005 |

X A/c

Dr.

Bill payable A/c

(Acceptance given to Mr. X) |

|

10,000 |

10,000 |

Transaction

No. 3

Acceptance is met

(paid of due date). The journal entry is:

4 April.

2005 |

Bill payable

A/c

Dr.

Cash A/c

(Acceptance is paid in cash) |

|

10,000 |

10,000 |

Different Uses of a Bill of Exchange:

In the above illustration, we just

discussed only one use of a bill of exchange

i.e., the drawer retained the bill with

himself till due date and then presented to

the acceptor, who honored the bill (paid

cash to the drawer). Every drawer or

receiver of a bill has three options for

him.

- He can retain the bill till the due date.

(As discussed above).

- He can send the bill to his bank for

collection. Bank will present the bill before

drawee on due date and will collect the amount

for drawer.

View accounting treatment for this option on "Bill of Exchange

Sent to Bank for Collection" page

- He can endorse the bill to one of his

creditors in settlement of his own debts.

View accounting treatment for this option on "Endorsement of Bill of Exchange"

page

- He can discount it with his bank if he is in

need of money and cannot wait till the due date.

View accounting treatment for this option on "Discounting of a Bill of Exchange"

page

In the same way every acceptor has four

possibilities.

- He may pay the amount of bill on

presentation. (As discussed above).

- He may refuse to honor the bill. It is

called dishonor of a bill of exchange. Read

Dishonor of Bill of Exchange

- He may request the drawer to renew the bill

(extending the period of payment). Read

Renewal of Bill of Exchange

- He may get the bill retired. (paying his

obligation before the due date). Read

Retiring

a Bill of Exchange Under Rebate.

|