|

When

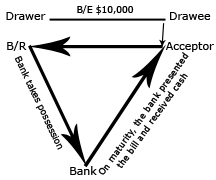

the acceptor of a bill of exchange is a reputable

person the bill is as good as money, and any bank

will discount it.

Definition and Explanation of

Discounting a Bill:

If the

drawer of the bill does not want to wait till the

due date of the bill and is in need of money, he may

sell his bill to a bank at a certain rate of

discount. The bill will be endorsed by the drawer

with a signed and dated order to pay the bank. The

bank will become the holder and the owner of the

bill. After getting the bill, the bank will pay cash

to the drawer equal to the face value less interest

or discount at an agreed rate for the number of days

it has to run. This process is know as

discounting of a bill of exchange.

Example:

For

example, a drawer has a bill for $10,000. He

discounted this bill with his bank two months before

its due date at 15% p.a. rate of discount. Discount

will be calculated as the follow:

1,000 × 15/100 × 2/12 = 250

Thus

the drawer will receive a cash worth $9,750 and will

bear a loss of $250.

The bank will keep

this bill in possession till the due date. On

maturity (due date) the bank will present the bill

to the acceptor and will receive cash from him (if

the bill is honored). In case, the acceptor does not

make the payment to the bank, then the drawer on any

person who has discounted the bill have to take this

liability and will pay cash to the bank.

Until the bill is

honored on the due date, there is always a chance

that the drawer will become liable on the bill. This

is called a contingent liability - a liability that

will only arise if a certain event occurs - the

acceptor does not honor the bill.

|

|

Drawer

discounted the bill for $9,750 and suffered a

loss of $250. In other words drawer had to

pay the price in order to receive the cash

before maturity. |

When a bill is

discounted by the holder, the following entries are

passed in the books of drawer, drawee and bank:

When the bill is

drawn by the drawer (A) and accepted by drawee (B)

|

Drawer's

Journal |

Drawee's

Journal |

B/R

A/C..................XXX

B A/C..................XXX

(Acceptance received) |

A

A/C..................XXX

B/P A/C.................XXX

(Acceptance given) |

|

When a bill is

discounted at bank: Bank A/C......................XXX

Discount A/C.................XXX

B/R A/C....................XXX

(Bill discounted at bank) |

No journal entry at the time of discounting

of bill in the books of drawee.

|

The entry for

discounting a bill in drawer's journal shows

increase in drawer's bank balance at present value

(face value - discount given), increase in a loss

(discount given) and decrease in an asset (bill

receivable).

The entry in the

journal of bank will be as under:

When a bill is

discounted at bank:

B/R A/C............XXX

Drawer A/C........XXX

Discount A/C.....XXX

(Bill discounted)

This journal entry

indicates, increase in assets (B/R) in the bank,

increase in a liabilities (the amount transferred to

the drawer's account) and in revenue for the bank

(discount).

When the bank

presented the bill to the acceptor on maturity date

and the acceptor met his obligation, the following

entries are passed:

|

Drawer's

Journal |

Drawee's

Journal |

Bank's Journal |

|

No entry in

the books of drawer. |

Bill payable

A/C...XXX

Cash A/C.........XXX

(Acceptance honored and cash paid to bank on

presentation of the bill) |

Cash

A/C.......XXX

B/R A/C.........XXX

(Cash received from acceptor equal to full

value of the bill) |

Note that the drawee pays full amount of the

bill to the bank at the time of maturity but

bank pays face value less discount to the drawer

when drawer discounts the bill with the bank.

This difference (discount) is revenue of the

bank and expense of the drawer. |