|

No

business wants to sell goods on credit to his

customers who may prove unable or unwilling to pay

their debts. Today, however, in every field of

retail trade it appears that sales and profits can

be increased by selling goods on credit basis. The

manufacturers and the wholesalers sell goods mostly

on credit. Credit is a very powerful instrument to

promote sales, so most of the business transactions,

in most business concerns, are carried on credit

basis. A bill of exchange is a method

of payment used between businessmen which has

certain advantages over other methods of payment.

Contents:

"An

unconditional order in writing, addressed by one person

to another, signed by the person giving it, requiring

the person to whom it is addressed to pay on demand or

at a fixed or determinable future time a sum certain in

money to or to the order of a specified person, or

to the bearer".

You should

keep in mind the following points to understand the

definition:

-

The

person who writes out the order to pay is called the

drawer.

-

The person

upon whom the bill of exchange is drawn (who is ordered

to pay) is called the drawee.

-

The drawee may

"accept" the bill. This is a special use of the word accept

because it means that he accepts to pay the amount payable

expressed in the bill, i.e. if he accepts the obligation to

pay he writes "accepted" across the face of the bill and

signs it. From that time on he is know as the "acceptor" of

the bill and has absolute liability to honor the bill on the

due date.

-

The amount of

money must be mentioned clearly. For example, I cannot make

out a bill requiring someone to pay the value of my car or

house. That is an uncertain sum. It must say "five thousand

dollars or ten thousand dollars" etc.

-

The time must be

fixed or at least be determinable. For example, "sixty days

after date" is quite easily determinable. If the bill is made

out on first July, it will be 29th august.

-

The person who is

entitled to receive the money from the acceptor is called the

"payee". It is usually the drawer who is supplying goods to the

value of the bill, and wants to be paid for them. If the drawer

decides, the bill can be made payable to someone else by

endorsing it. That is why the definition says, to pay..... to, or

the the order of, a specified person.

-

A bill can be made

payable to a bearer, but it is risky, since any finder of the bill

or any thief, can claim the money from the acceptor.

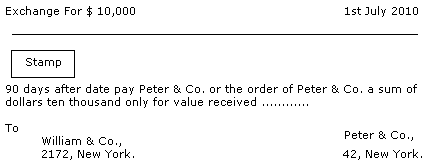

Now read the definition

again and see the format of the bill of exchange below:

Important Points:

-

This bill is drawn by

the peter & Co., so the drawer of the bill is peter & Co.

-

The bill is drawn upon

William & Co., so they are drawee of the bill. They have not yet

accepted the bill, and so are not liable to pay it at maturity.

-

The bill is an

unconditional order in writing. It says "pay ten thousand dollars to

Peter & Co." it does not say "provided you are in funds". It just says

"pay!".

-

It is addressed by one person

(Peter & Co.) to another (William & Co.) and is signed by the person giving

it (Peter & Co.).

-

The date is easily determinable it is 90 days after first July, which is 29 September, 20....

-

The sum of money is very certain,

ten thousand US dollars.

-

The bill is payable to, or to the

order of, Peter & Co.

-

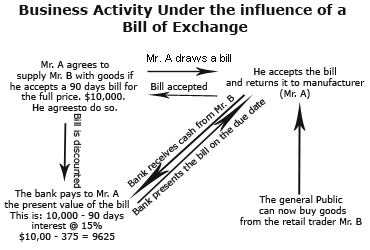

A person who wants to purchase

goods but has no money, may agree to accept a bill of exchange drawn upon

him at some future date for the value of the goods he wants to purchase. For

example, Mr. B (a retail trader) wishes to purchase furniture from a

furniture manufacturer (Mr. A) but has no money. Mr. A is agreed to sell

furniture for a 90 days credit worth $10,000.

-

The drawer (Mr. A) draws a bill

for $10,000 on the customer (Mr. B), the drawee, who accepts it (thus becoming

the acceptor of the bill) and returns it to the drawer. The drawer delivers the

furniture and has a 90 days bill for $10,000.

-

He can keep the bill till due date

and present it on the due date before the acceptor.

-

When a drawee (the acceptor)

acknowledges the obligation in the bill he is bound by law to honor the bill on

the due date. If he is a reputable person the bill is as good as money, and any

bank will discount it. There are special kinds of banks which do this job and

they are called discount houses. What do the discount houses do? They cash the

bill by giving the drawer the present value of the bill.

Present Value = Face value of the bill -

Interest at agreed rate for the time the bank has to wait

So the drawer

who discounts the bill with the bank gets less than the face value.

- On the due date the bank will present the bill

to the acceptor, who honors it by paying the full value. The bank has earned

the amount of interest it deducted when it discounted the bill.

Where does the acceptor get the money to honor

the bill? The answer is that he was given 90 days to sell the goods at profit,

and therefore, he is liable to honor the bill. Now it is hoped that you will be

able to follow what is happening in the following diagrams:

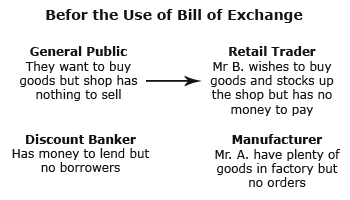

You can understand the figure above with the

help of the following notes:

- Business activities cannot proceed because

the retail trader (Mr. B) has nothing to sell and has no money to buy goods.

- We need a system by which retailer can

purchase goods without paying for them at the moment and which enables the

manufacturer (Mr. A) to be paid immediately.

- Since a bill of exchange from a reputable

trader is almost as good as money, it will be acceptable to banks. They have

plenty of money to lend out to reliable customers so, they will advance

money to the holder of bills of exchange.

Now look at the following figure and note how bill

of exchange can increase the business activities.

The result is that a bill of

exchange is a useful instrument to increase business activities, and is

beneficial to all the parties. |