|

Learning objectives of this

article:

-

What is an annuity?

-

How the future value of an

annuity is calculated?

-

Examples

Contents:

An annuity is a series of periodic payments.

Examples of annuities include regular deposits to a

saving account, monthly car, mortgage, or insurance

payments, and periodic payments to a person from a

retirement fund. Although an annuity may vary in

dollar amount, we will assume that an annuity

involves a series of equal payments. We will also

assume that the payments are all made at the end of

a compounding period. One may certainly argue

that end of one period coincides with the beginning

of the next period. The important point is that

payment does not qualify for interest in the

previous period but will earn full interest during

the next period.

Following is the illustration of a series of

payments R, each of which equals $1,000.

These might represent year-end deposits in a savings

account or quarterly tax payments by a self-employed

person.

Annuity

Future value of a lump sum investment is

explained on the

future value of a single sum page.

In this article future value or sum of an annuity is

determined.

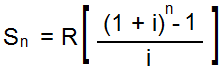

The following formula is used to calculate future

value of an annuity:

|

- R = Amount an annuity

- i = Interest rate per period

- n = Number of annuity payments

(also the number of compounding

periods)

- Sn = Sum (future

value) of the annuity after n

periods (payments)

|

Example:

A person plans to deposit $1,000 in a

tax-exempt savings plan at the end of this year

and an equal sum at the end of each following

year. If interest is expected to be earned at

the rate of 6 percent per year compounded

annually, to what sum will the investment grow

at the time of the fourth deposit?

Solution:

Example:

A teenager plans to deposit $50 in savings

account at the end of each quarter for the next

6 years. Interest is earned at a rate of 8

percent per year compounded quarterly. What

should her account balance be 6 years from now?

How much interest will she earn? Solution:

|

In this example:

- R = $50

- i = 0.08/4 = 0.02

- n = (6 years

×

4 quarters per year) = 24

S4 =

$50(30.42186*)

= $1,521.09

*

Future value of ordinary annuity

table Over 6-year period she will

make 24 deposits of $50 for a total

of $1,200. Interest for the period

will be $1,521.09 - $1,200.00 =

$321.09 |

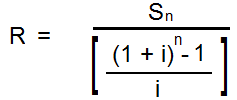

The above formula can be solved for any of the

four parameters, given values for the other three.

For example, we might have a goal of accumulating a

particular sum of money by some future time. If the

rate of interest which can be earned is known, the

question becomes, what amount should be deposited

each period in order to reach the goal? In other

words formula can also be used to determine the size

of an annuity. For this purpose, formula can be

solved for R:

Suppose a corporation wants

to establish a sinking fund beginning at the

end of this year. Annual deposits will be

made at the end of this year and for the

following 9 years. If deposits earn interest

at the rate of 8 percent per year compounded

annually, how much money must be deposited

each year on order to have $12 million at

the time of the 10 deposit? How much

interest will be earned?

Solution:

- n = 10

- i = 0.08

- Sn = $12,000,000

- R = ?

The money to be deposited each year

(R) is calculates as follows:

R = $12,000,000 / 14.48656*

R = 828354 *

Future value of ordinary annuity

table Since 10 deposits of

$828,354 will be made during this

period, total deposits will equal

$8,283,540. Because these deposits

plus accumulated interest will equal

$12 million, interest of $12,000,000

- $8,283,600 = $3,716,400 will be

earned. |

|