|

Learning objectives of this

article:

-

Define a explain the present value of an

annuity.

-

How is it calculated?

-

What are the benefits of its calculation?

Contents:

The present value of an annuity is

an amount of money today which is equivalent to a

series of equal payments in the future. For example,

you have won a lottery and lottery officials give

you the choice of having a lump-sum payment today or

a series of payments at the end of each of the next

5 years. The two alternatives would be considered

equivalent (in a monetary sense) if by investing the

lump-sum today you could generate (with accumulated

interest) annual withdrawal equal to five

installments offered by the lottery. An assumption

is that the final withdrawal would deplete the

investment completely. Consider the following

example.

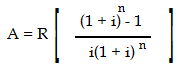

Following formula is use for the calculation of

present value of an annuity:

|

- R = Amount of an annuity

- i = interest rate per

compounding period

- n = Number of annuity payments

(also, the number of compounding

periods)

- Present value of the annuity

|

A person recently won a state lottery. The terms

of the lottery are that the winner will receive

annual payments of $20,000 at the end of this year

and each of the following 3 years. If the winner

could invest money today at the rate of 8 percent

per year compounded annually, what is the present

value of the four payments?

Solution:

There are problems in which we may be given the

present value of an annuity and need to determine

the size of the corresponding annuity. For example,

given a loan of $10,000 which is received today,

what quarterly payments must be made to repay the

loan in 5 years if interest is charged at the rate

of 10 percent per year, compounded quarterly? The

process of repaying loan by installment payments is

referred to as amortizing a loan.

To determine the size of an annuity, the formula

is solved for R:

The quarterly payment necessary to repay the

above motioned $10,000 is calculated as

follows:

|